What is a multilateral venue?

There will be three multilateral venues under MiFID II, as follows:

- A Regulated Market (RM), which is a multilateral system operated by a market operator, which brings together or facilitates the bringing together of multiple third-party buying and selling interests in financial instruments – in the system and in accordance with its non-discretionary rules – in a way that results in a contract, in respect of financial instruments admitted to trading under its rules and/or systems, and which is authorised and functions regularly and in accordance with Title III of MiFID II. The list of RMs currently includes the London Stock Exchange Main Market, BATS Europe, Intercontinental Exchange Futures Europe, Euronext London and LIFFE.

- A Multilateral Trading Facility (MTF), which is a multilateral system, operated by an investment firm or a market operator, which brings together multiple third-party buying and selling interests in financial instruments – in the system and in accordance with non-discretionary rules – in a way that results in a contract in accordance with the provisions in Title II of MiFID II as outlined in the diagram below. The list of MTFs currently includes Brokertec Europe Limited, BATS Trading Ltd, EuroMTS, ICAP Global Derivatives Limited, London Stock Exchange AIM, and Smartpool Trading Limited.

- An OTF, which is a multilateral system that is not an RM or an MTF and in which multiple third-party buying and selling interests in bonds, structured finance products, emission allowances or derivatives are able to interact in the system in a way that results in a contract in accordance with Title II of MiFID II as outlined in the diagram below. Equities are not permitted to be traded through an OTF. Unlike an RM or an MTF, an OTF operator will have discretion over the execution of transactions on its platform. Discretion will be deemed to be exercised at two levels: (a) when the OTF operator decides to send an order to the OTF or to retract it; and (b) when the OTF operator decides not to match a specific order with other orders available in the system at a given time. For an OTF operator that crosses clients’ orders, discretion will be deemed to be exercised if the operator decides if, when and how much of two or more orders it wants to match within its system. As a consequence, OTF operators will be subject to the MiFID conduct of business requirements including best execution, client order handling, conflicts of interest, appropriateness and inducements.

Are there any restrictions?

Generally, operators of MTFs and OTFs will not be permitted to deal on own account or engage in matched principal trading. However, an OTF operator can deal on own account in relation to illiquid sovereign debt. In addition, an OTF operator can conduct “matched principal trading” provided that both sides of the trade are executed simultaneously and the clients consent. Such “matched principal trading” cannot be conducted by an OTF operator specifically in relation to derivatives which are subject to mandatory clearing under EMIR. This restriction on dealing on own account also applies to any entity that is part of the OTF operator’s corporate group, which means that whilst market makers can access an OTF, they must not be part of the same group as the OTF operator.

An OTF operator cannot operate an SI (see below) or connect with another OTF or SI. This may require some firms to reorganise their business from a legal and operational perspective to ensure that the functions of an SI and OTF are housed in separate legal entities.

The FCA has indicated in CP15/43 that it may propose guidance to make clear that the restriction on proprietary trading does not prevent an MTF operator from executing orders against its capital or engaging in "matched principal trading" outside the MTF it operates.

ESMA is expected to produce a Level 3 Q&A document to provide market operators with further guidance on the key differences between MTFs and OTFs.

What about the new SI regime?

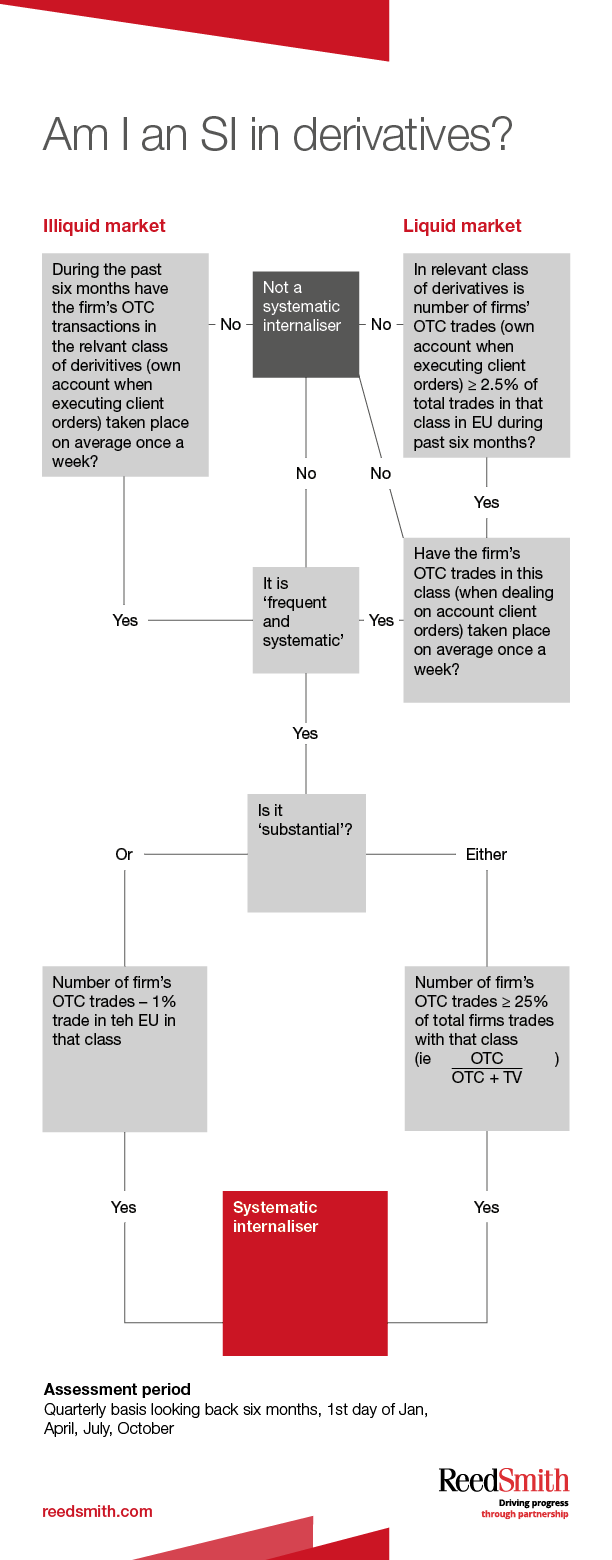

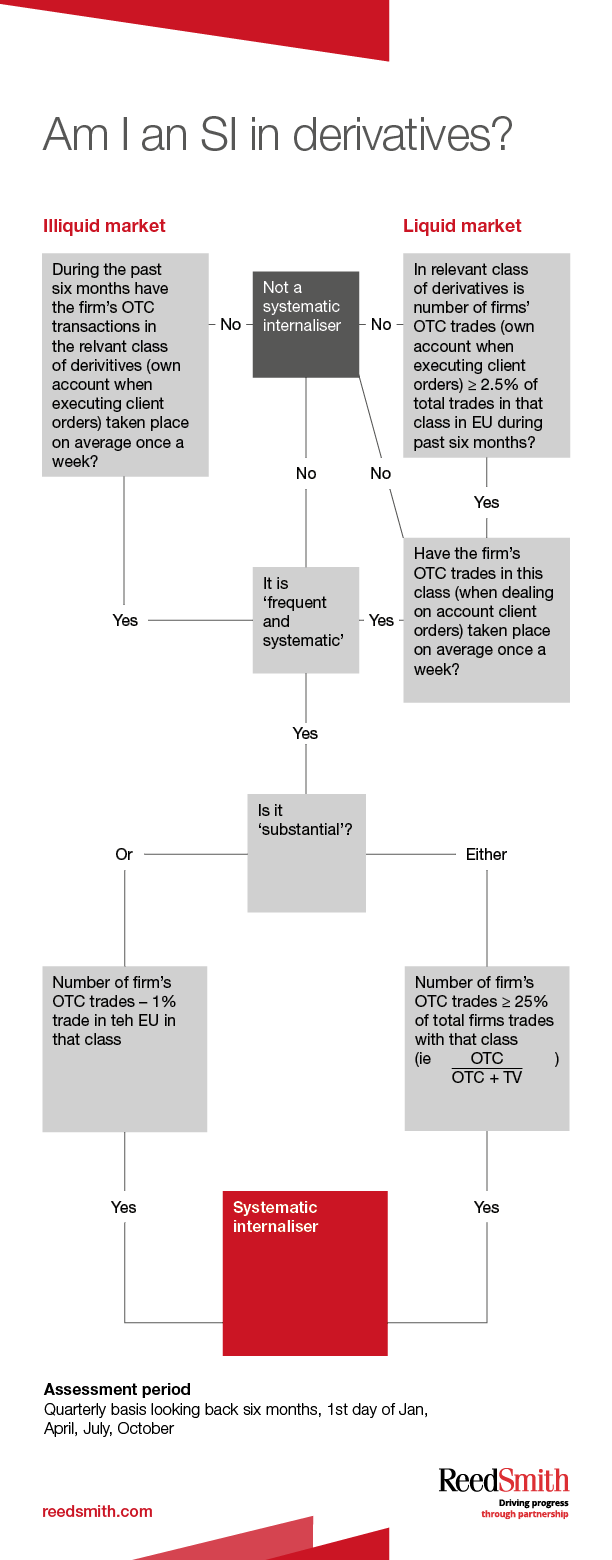

The SI regime which currently applies only to trading in equities will be extended to a wider range of instruments. The instruments that will become subject to the SI regime for the first time are non-equity instruments such as bonds and derivatives and also equity like instruments such as ADRs and ETFs. The regime applies to investment firms who execute client orders on own account on an “organised, frequent, systematic and substantial basis” outside a RM, MTF or OTF as outlined in the diagrams below.

MiFID II introduces new quantitative criteria for determining an investment firm’s status as an SI on a specific financial instrument basis. SI status will apply where the pre-set limits for the frequent/systematic test and for the substantial basis test are both crossed or where the firm chooses to opt-in to the SI regime.

What does this mean for me?

Operators of RMs, MTFs and OTFs will be required to be authorised by a Member State Regulator and once authorised will be subject to certain organisational, market surveillance and conduct requirements.

Trades executed on an RM, MTF, OTF or an “equivalent third country venue” (i.e. a non-EU venue that has been deemed equivalent by the European Commission) will enable counterparties to comply with the new mandatory “on-exchange” trading requirement for derivatives in MiFID II. An SI is not a relevant venue for these purposes. Non-EU investment firms and market operators will have to take steps to ensure that equivalence is granted in addition to considering how to access and thus retain EU business post-MiFID II.

Trades executed on an RM, MTF, SI or an equivalent third country venue will enable counterparties to comply with the new mandatory “on-exchange” trading requirement for shares and equity-like instruments in MiFID II. An OTF is not a relevant venue for these purposes.

Trades executed on an OTF and an MTF or with an SI will still be treated as OTC for the purposes of EMIR and so counterparties that execute trades on such venues will still have to comply with the reporting, risk mitigation and clearing obligations under EMIR (where applicable).

Next steps

It is important that investment firms and market operators understand their regulated status under MiFID II. Certain restrictions and mandatory trading requirements, both in relation to equities and derivatives instruments under MiFID II, will affect the existing business of these operators and firms, including non-EU investment firms and market operators who currently access the European market under an exemption (e.g. on the basis of the UK's overseas persons exemption).

The FCA has indicated that it hopes to open the authorisation application gateway for new regulated activities under MiFID II at the beginning of 2017. The FCA is expected to publish an applications and notifications guide once the Level 2 delegated acts have been finalised, which is expected shortly.