Currently, a significant number of countries are introducing new rules on foreign direct investment to strengthen measures of screening from the national security viewpoint – most recently China, as detailed in our previous alert.

In the UK, the government published the National Security and Investment Bill (the Bill) in November 2020, and it has been under discussion in Parliament. In Japan, the Foreign Exchange and Foreign Trade Act (FEFTA), its regulations, and public announcements (collectively, FEFTAs) took effect in May and June 2020 and have been implemented respectively. This client alert analyses the differences between the regimes and discusses whether the UK should adopt any of the Japanese exemptions.

Notification/Report system

Both the UK and Japanese systems have mandatory prior notification for designated business sectors.

The UK has a voluntary regime for mergers generally and a high filing fee of up to £160,000, which means that filings are not expected unless there is a potential competition issue. The proposed UK foreign investment regime introduces a mandatory notification regime for those sectors which pose the greatest risk, with a voluntary notification regime for all other sectors with an enhanced call-in power, with no filing fees. The exact scope of the mandatory sectors is yet to be defined.

On the other hand, while Japan has no official voluntary notification system in the FEFTAs, it requires foreign investors to submit a mandatory post-notification report in certain situations. If required, foreign investors shall submit the report within 45 days after their transactions made.

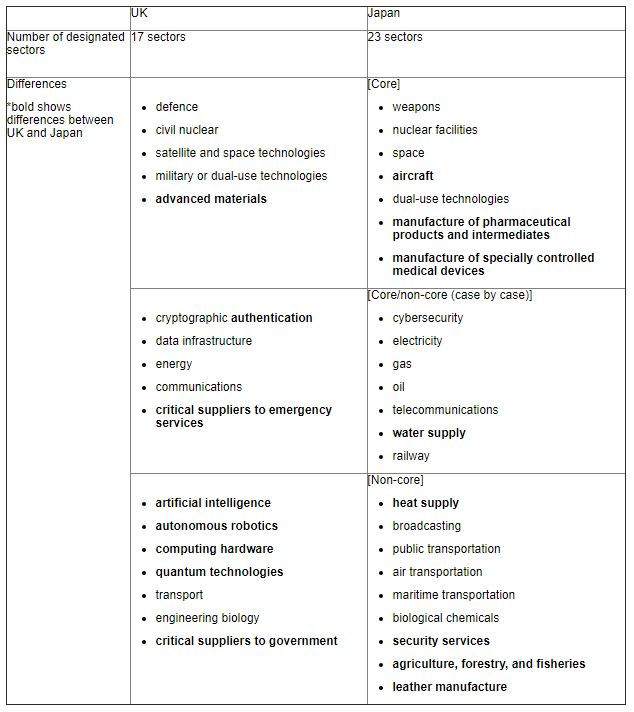

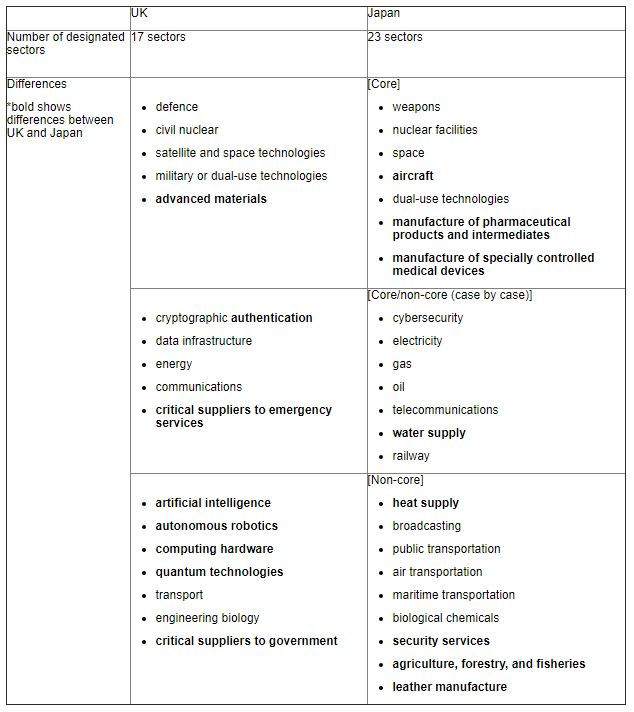

Designated business sectors as to mandatory prior notification

There are several differences for designated business sectors, while there are some similarities (see the table above). The Japanese list is more specific, for example, referring to different types of transport such as public, air, and maritime transport while the UK list refers simply to transport. The UK wide and non-specific approach is likely to result in many approaches seeking clarification as to what exactly is included in a designated sector. For example, it can’t be intended that every acquisition in the energy sector has a mandatory filing requirement, can it?

In Japan, the above 23 sectors are subject to the mandatory notification unless exempted (discussed below). The sectors are divided into two types according to the degree to which they affect national security: core designated business sectors and non-core designated business sectors. As for all listed companies, the Japanese authority published a list that classifies each company in one of the following categories (the list of classifications is found on the Japanese Ministry of Finance website: mof.go.jp).

- Companies conducting business activities in non-designated business sectors; such are subject to post-investment report only.

- Companies conducting business activities only in non-core designated business sectors.

- Companies conducting business activities in core designated business sectors.

Threshold for mandatory notification and exemptions including accreditation system

In the UK, the Bill provides that the government does not need to comply with any turnover or market share thresholds. The only requirement to justify intervention is that the target carries on activities or supplies customers in the UK.

Whereas in Japan, the prior approval requirement for listed companies is triggered when an investor holds 1 percent of the outstanding shares or voting rights subsequent to the investment either on their own or together with closely related persons. There is no threshold for non-listed companies.

There are two possible exemptions from the prior notification for foreign investors: a blanket (block) exemption and an individual exemption. These exemptions cannot be used by (i) state-owned enterprises or (ii) companies that have violated the regulation in the past. In addition, post-notification may be required in some cases.

(1) Blanket exemption

The blanket exemption is available only to “foreign financial institutions” which are subject to regulations/supervisions under financial regulatory laws in Japan or other jurisdictions – for example, securities firms, banks, insurance companies, asset management companies, trust companies, registered investment funds (including mutual funds and exchange-traded funds), and high-frequency traders.

If these institutions fulfil certain exemption criteria, they may invest in publicly traded Japanese companies with no upper limit without having completed the prior notification. However, a post-acquisition notification is still required for investments of more than 10 per cent of the voting rights of a publicly traded Japanese company operating in a designated business sector. In addition, a foreign investor proposing to invest in a privately owned Japanese company operating in a core sector will still be required to undergo the prior notification process.

(2) Individual exemption and accreditation system

The individual exemption is available to foreign investors, including sovereign wealth funds and public pension funds (SWFs) accredited by the MoF, that will make such investments for economic reasons and without any government intervention.

In principle, state-owned enterprises are not eligible for the exemption from the prior notification. However, SWFs which are deemed to pose no risk to national security are eligible for the individual exemption if accredited by the authorities. The UK does not set such system at present.

For the accreditation, the MoF will review whether:

- Investment activities of the SWFs are only for economic returns; and

- Investment decisions by the SWFs are made independently of their governments.

The MoF will sign a Memorandum of Understanding (MOU) with the SWFs to grant the accreditation. The decision of an accreditation and the signing of an MOU will be kept confidential.

If they fulfil certain exemption criteria, foreign investors proposing to invest in non-core sector businesses may invest without any upper limit and without having to complete the prior notification process. However, a post-acquisition notification is still required for investments of more than 1 per cent of the voting rights of the target company.

The Japanese exemptions – whether blanket (block) or specific – do seem very sensible in order to cut out obviously non-hostile investments and to encourage the continuation of much-needed good investments, so we would recommend that the UK authorities looked into this as a possible option.

Client Alert 2021-009