Conceptually, save for the reporting obligations unique to the UK regime, each guidance discusses the following key elements:

- Exceptions for non-Russian oil products that originate in a third country and are only being loaded in, departing from or transiting through Russia, as well as other limited derogations and exceptions

- Types of transactions and scenarios the price cap applies to

- “Tier” list of different categories of actors

- Recordkeeping and attestation process

- Reporting obligations (UK only)

Do the price cap restrictions apply to non-Russian oil products that originate in a third country and are only being loaded in, departing from or transiting through Russia?

No, the guidance from all three jurisdictions are aligned. In particular, oil products that originate in a non-Russian country, whose owner is non-Russian and that are only being loaded in, departing from or transiting through Russia, are exempt from the price cap. Further, products of non-Russian origin that contain a de minimis amount of Russian oil left over from a container, pipeline or tank will not be considered to be of Russian origin and thus will not be subject to the restrictions.

What types of transactions/scenarios do the price cap restrictions apply to?

The price cap restrictions apply from shore to shore, that is, from receipt of the Restricted Oil Product onboard a ship up to the point where it is delivered to a third country and substantially transformed into a different good in line with the applicable rules of origin (e.g., the resulting product comes under a different HS/CN code).

The price cap covers only the price for the purchase of Restricted Oil Products. Ancillary costs, including, but not limited to, freight, insurance and transportation costs as well as legal fees, are not subject to the price cap.

The EU and U.S. recognise that some parties may need to adjust their invoicing and recordkeeping models and processes in order to distinguish the price of the Restricted Oil Products from the costs associated with transportation and other related services. E.g. Tier 1 actors that purchase Restricted Oil Product by contracting on “Cost, Insurance, Freight” terms, should require a breakdown of the ‘Cost’ element in order to identify the different expenses and also keep a record of the relevant agreement.

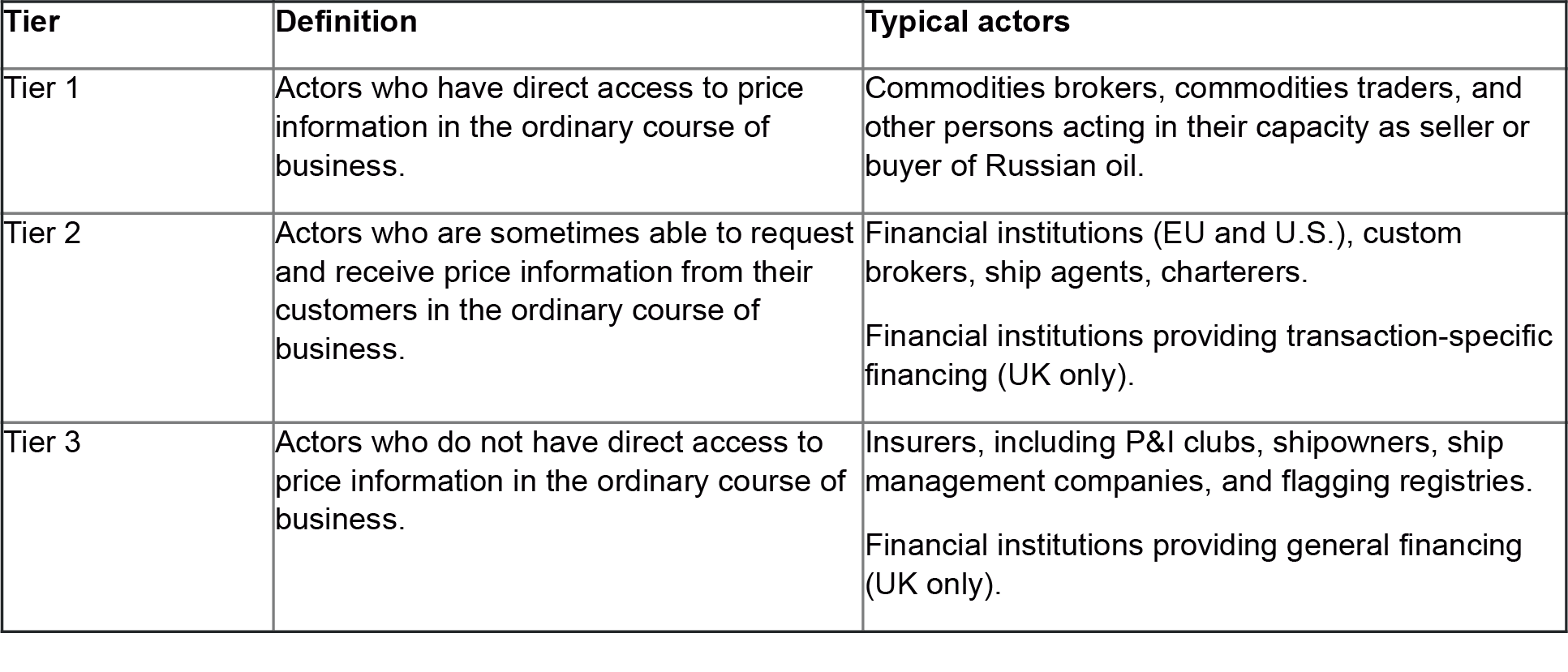

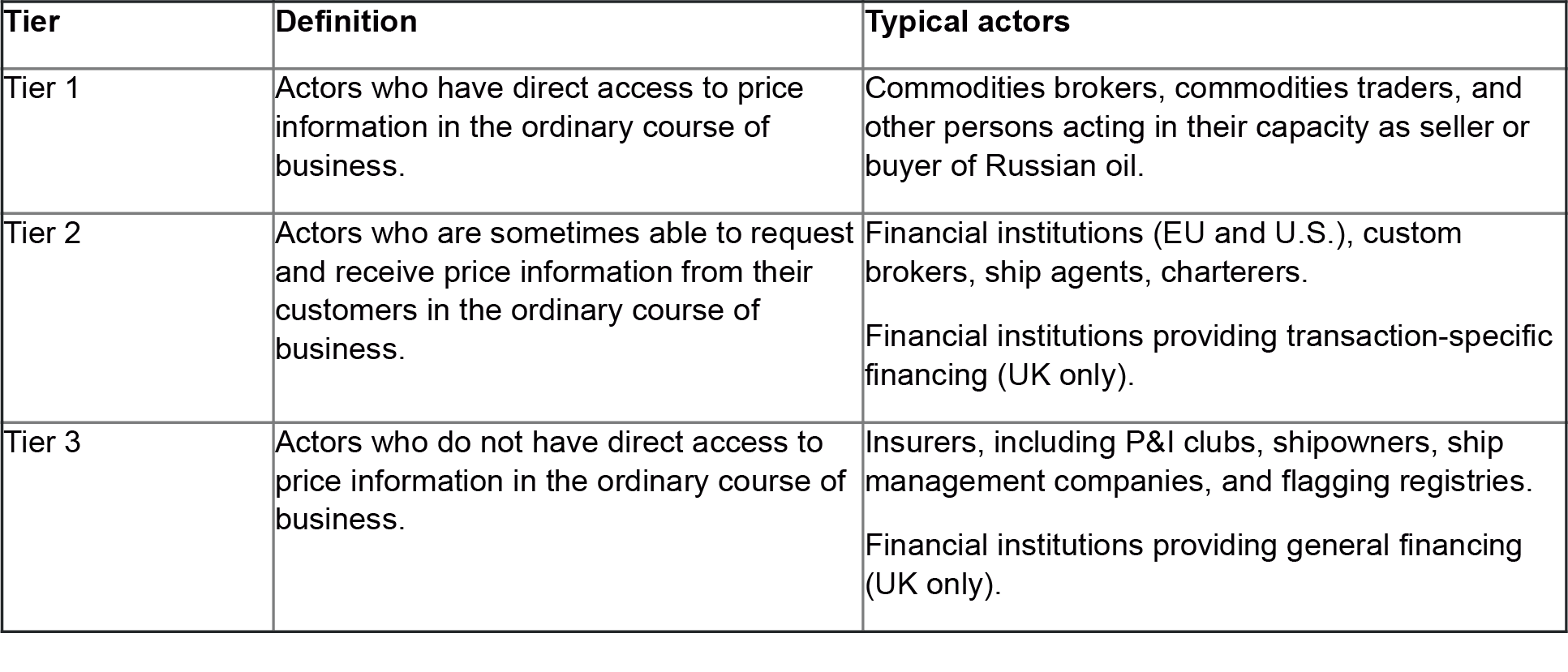

What are the different “Tiers”

There is now an agreed three-tier system across the U.S., UK and EU, summarised in the table below:

The key difference is that, while the EU and the U.S. guidance state that financial institutions providing transaction-specific trade and general financing both fall under Tier 2, the UK guidance suggests that financial institutions providing general financing could fall under Tier 3 instead.

Notwithstanding this nuance, it is unlikely to impact how the “safe harbour” (discussed in the section below) operates in practice for such financial institutions – although if such financial institutions are UK entities, it may affect the frequency of their reporting requirements.

How does the recordkeeping and attestation process work?

Each guidance states that the attestation process is additional to the typical due diligence and KYC checks that market participants are expected to conduct for each trade. There is no definitive guidance on the level of due diligence required by the parties in the supply chain of Restricted Oil Products; however, expectations are likely to draw on previous industry guidance issued to the maritime community. Indeed, the EU guidance refers to:

- operators implementing a sanctions compliance programme reflecting their exposure and the nature of their business; and

- adopting best practices, including AIS monitoring, contractual requirements, KYC practices and supply chain due diligence.

The UK guidance also expects parties that are already subject to due diligence requirements to continue to apply these and such due diligence requirements also form part of the conditions of the UK General Licence discussed below.

Whilst not explicitly stated, it seems that Tier 2 and Tier 3 actors are unlikely to be required to “look behind” attestations in ordinary circumstances, but may be required to do so if, in the course of their usual due diligence checks, there are factors which give reasonable cause to do so (e.g., sanctions red flags, high risk factors). For example, OFAC’s guidance indicates that OFAC would not pursue a penalty against a U.S. service provider that reasonably relies on the documentation or attestations, unless the U.S. provider knew or had reason to know that such documentation was falsified or erroneous or that the Russian oil was purchased above the relevant price cap.

Compliance with the requisite attestation obligations provides the relevant actor with a “safe harbour”. This is because the attestation is designed to protect parties in the supply chain of Restricted Oil Products from liability for breach of sanctions in cases where they inadvertently deal with Restricted Oil Products sold above the price cap owing to falsified or erroneous records provided by counterparts who act in bad faith and/or make material misrepresentations.

A sample attestation is suggested in each guidance. These are substantively the same, with only subtle differences to reflect the wording of the legal text of the relevant regimes’ restrictions.

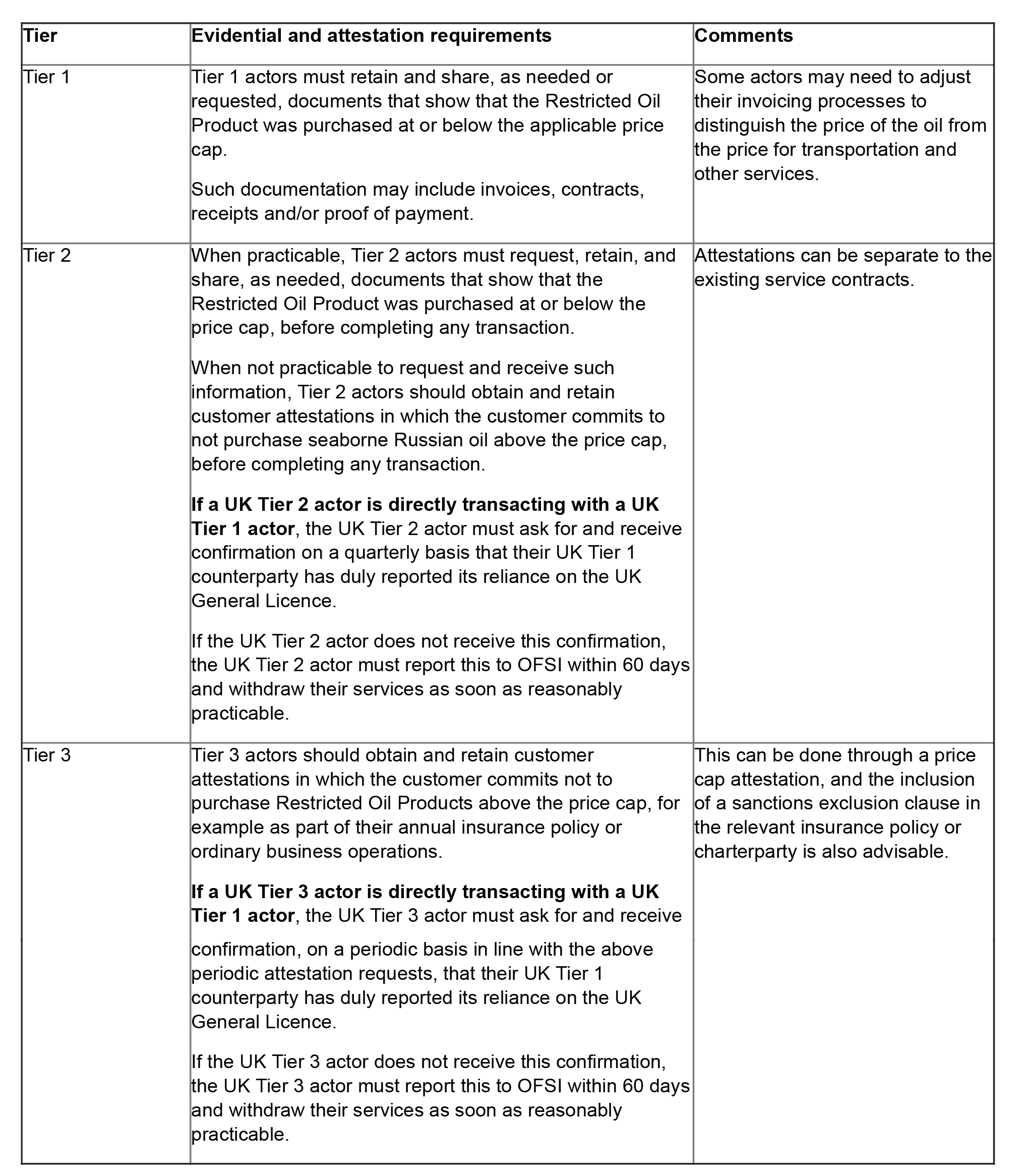

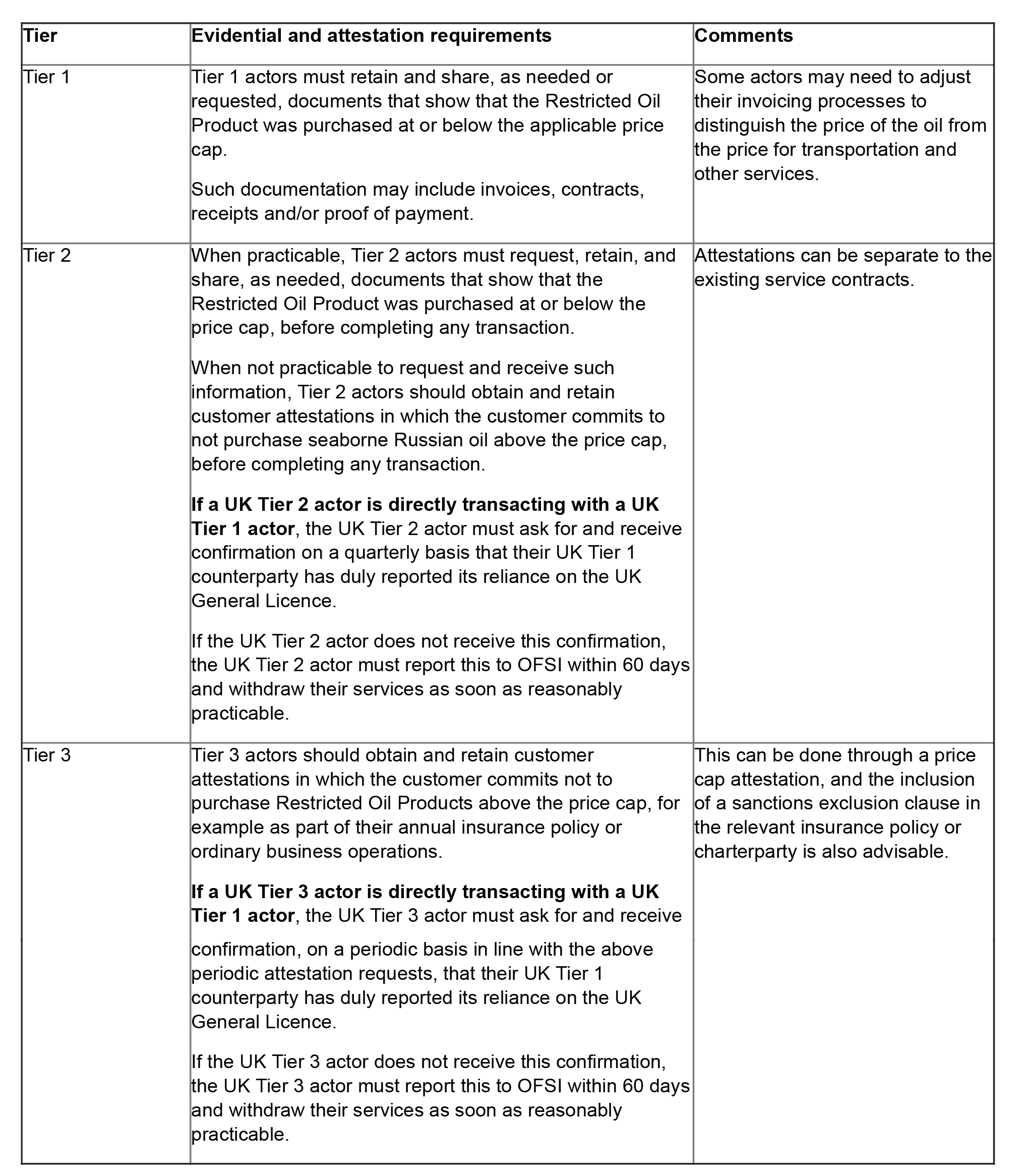

The evidential and attestation obligations differ across the tiers:

Whereas the EU and the U.S. guidance provide that documentary evidence and attestations should be kept for a minimum of five years from the date of transportation or the transaction, the UK imposes a recordkeeping requirement of four years beyond the end of the calendar year in which the record was created.

What are the reporting obligations in the UK?

The UK General Licence relating to the 45 day wind-down and the Price Cap General Licence, as well as the accompanying guidance, goes slightly further than the EU and the U.S. by imposing a reporting obligation on UK actors. These are briefly summarised in the table below.

In-depth 2022-390

In-depth 2022-390

In-depth 2022-390

In-depth 2022-390