Background

Hong Kong law traditionally prohibited Hong Kong based arbitration lawyers from entering into contingency fee arrangements with their clients. Since 22 June 2022, such restriction has been lifted by the newly added Part 10B of Hong Kong’s Arbitration Ordinance (Cap. 609) (“Ordinance”).

As we discussed in our previous alert, the Ordinance has permitted the use of ORFS by both Hong Kong and foreign qualified lawyers in arbitrations seated in and outside of Hong Kong (Articles 98ZI and 98ZA of the Ordinance). The ORFS regime applies only to arbitration, emergency arbitration, related mediation and court proceedings (e.g. applications to Hong Kong courts to enforce or set aside an arbitral award).

The Ordinance provides for three types of ORFS:-

- Conditional fee agreement (“CFA”) under which the client agrees to pay the lawyer a success fee in the event of a successful outcome in the matter.

- Damages-based agreement (“DBA”) under which the lawyer only receives payment if the client obtains a financial benefit (which means “any money or money’s worth” but excludes any awarded legal fees and expenses 1 in the matter, and such payment is calculated by reference to the financial benefit, such as a percentage of the monetary sum awarded to the client.

- Hybrid damages-based agreement (“Hybrid DBA”) under which the client agrees to pay the lawyer not only a fee (which is usually discounted) for the legal services rendered by the lawyer during the course of the matter but also an additional fee in the event that the client obtains a financial benefit.

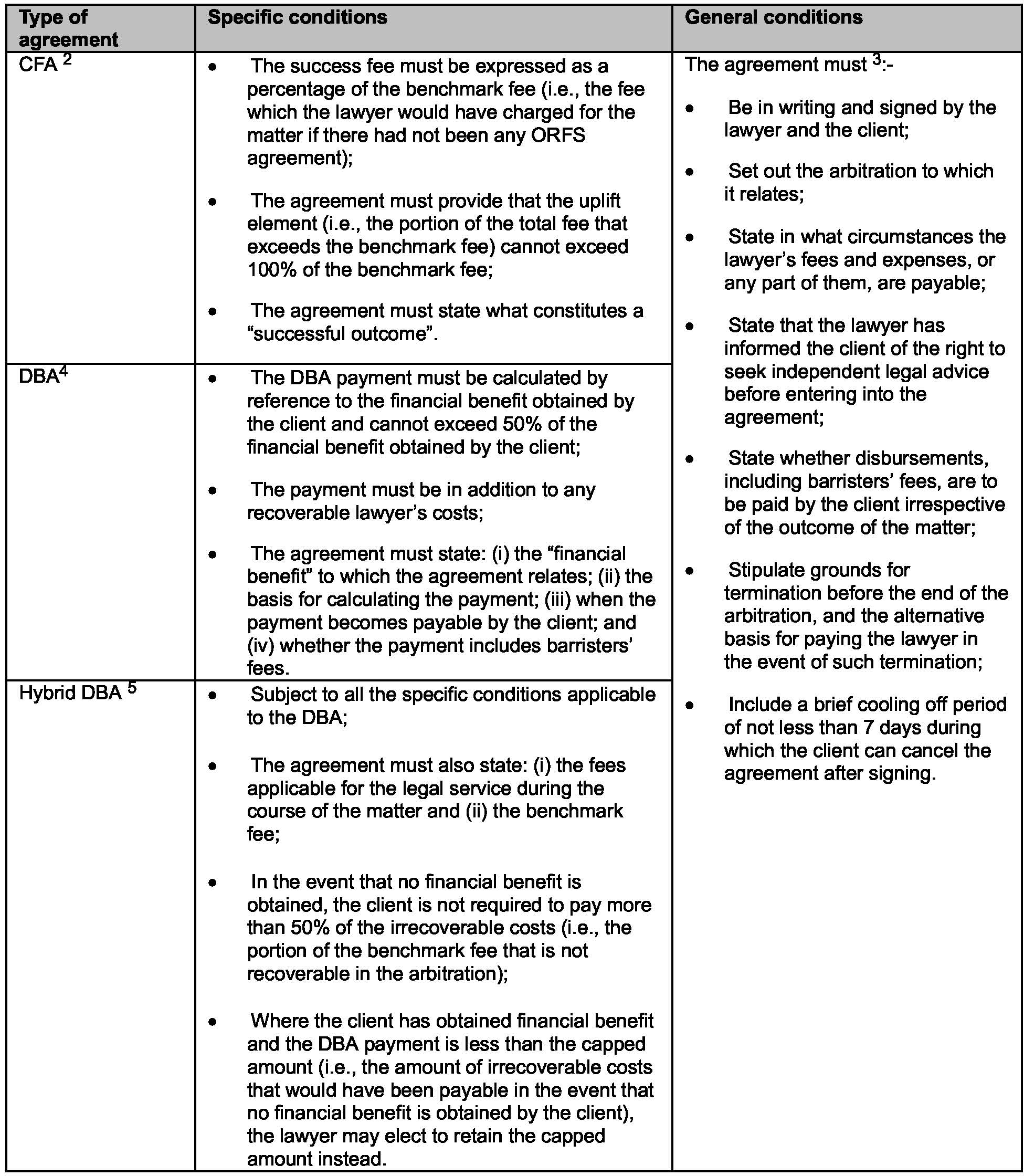

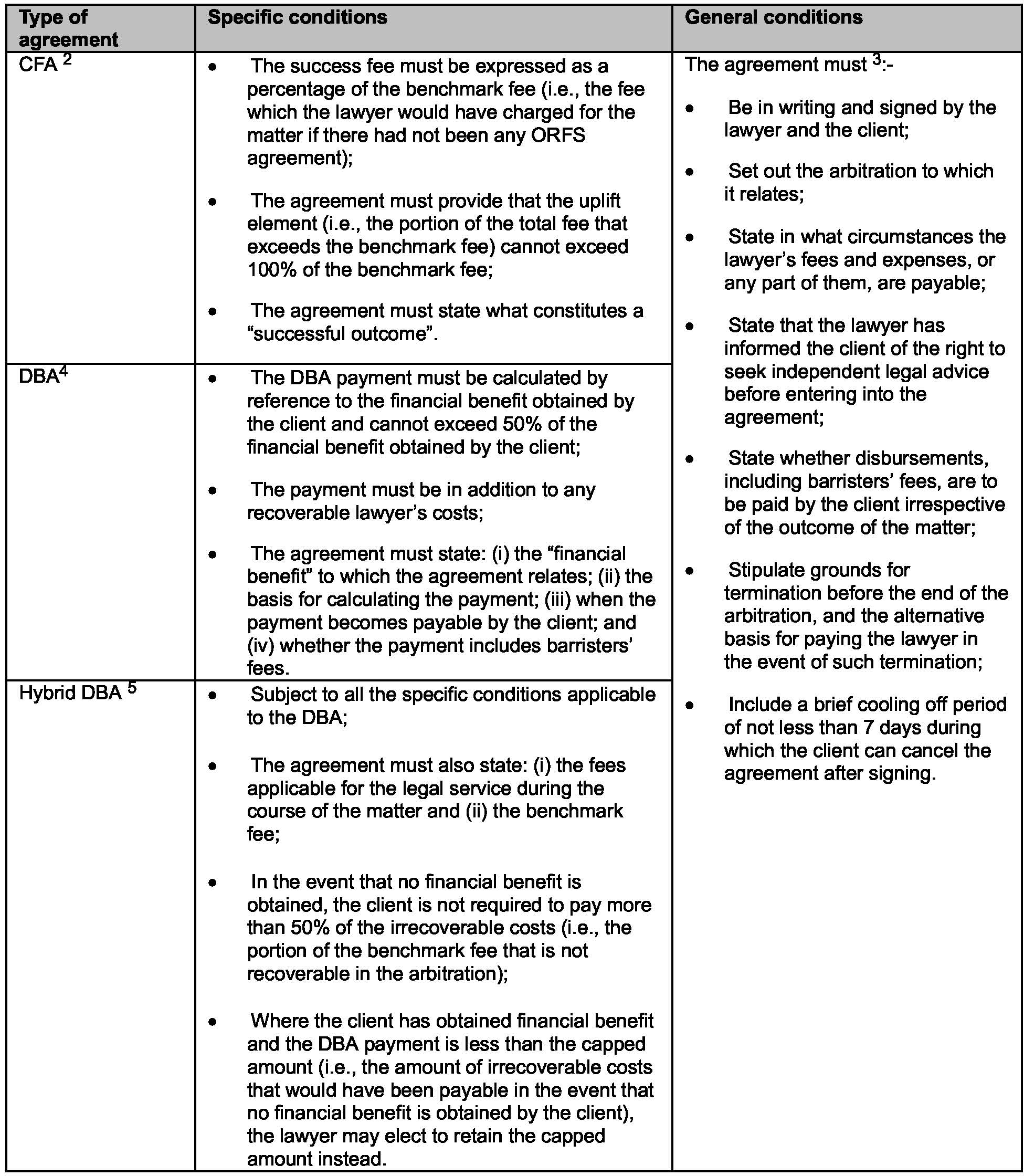

The Ordinance provides for the validity and enforceability of the above ORFS agreements if they meet the general and specific conditions, set out in the Rules.

General and specific conditions for ORFS agreements

We have summarised below the general conditions applicable to all types of ORFS agreements and specific conditions applicable to each of them. Arbitration users are recommended to include all essential terms to ensure the enforceability of their ORFS agreements.

Contingency fee agreements in other seats of arbitration

Mainland China

PRC law generally permits all types of contingency fee agreements (CFAs, DBAs and Hybrid DBAs) to be used in commercial litigations and arbitrations. PRC law allows the contingency fee to be charged on the basis of (i) a fixed amount or (ii) a certain percentage of the amount of realised debt or the amount of reduced or exempted debt (such amount is defined as "subject amount" under PRC law).6 Compared with the Hong Kong DBA regime, PRC law imposes a lower cap on the recoverable contingency fee, which was 30 per cent7 and is now lowered to be in the range of 6 per cent to 18 per cent, depending on the subject amount.8 The Ministry of Justice lowered the cap out of its concern about the excessive amount of contingency fee.9

PRC law requires that contingency fee agreements be in writing and lawyers must bring to their clients’ attention the terms and risks thereunder.10 Such requirement, similar to the general conditions under the Hong Kong ORFS regime, serves the purpose of levelling the playing field for layman clients and legal professionals.

Singapore

Singapore qualified lawyers and registered foreign lawyers are now able to enter into CFAs for arbitration and related court proceedings.11

Unlike the CFA regime in Hong Kong, the uplift fees under the Singapore regime are not subject to any caps or limits. Having said that, CFAs are still subject to Singapore professional conduct rules that require lawyers to charge fees that are fair or reasonable relative to the work done.

Another key difference is that DBAs (which are allowed under Hong Kong’s ORFS regime) are still prohibited under Singapore law.12

Similar to the ORFS regime in Hong Kong, Singapore law also requires lawyers to provide certain information to clients before entering into CFAs, including (i) the nature and operation of the CFA and its terms; (ii) the client’s right to seek independent legal advice before entering into the CFA; (iii) that the uplift fees are not recoverable by or against a person who is not a party to the CFA; and (iv) that the client continues to be liable for any costs orders that may be made against it by the court or arbitral tribunal.

Conclusion

The implementation of the Rules would increase the popularity of the Hong Kong ORFS regime among arbitration users. The new ORFS regime is considered as a client-friendly regime because it provides not only alternative funding options but also prescribed measures to safeguard clients’ right to information.

With more jurisdictions legalising contingency fee arrangements (including Hong Kong, Mainland China, and Singapore), clients will have more pricing options for cross-border dispute resolution. However, it is worth noting the differences between the regulations of each jurisdiction so as to give full effect to the contingency fee agreements.

Reed Smith has offices in Mainland China, Hong Kong and Singapore and we have a wealth of experience in providing optimal pricing arrangements in cross-border disputes. Please feel free to contact us if you have any questions about contingency or other conditional fee arrangements.

- Article 98ZA of Hong Kong’s Arbitration Ordinance (Cap. 609).

- Rule 4 of Arbitration (Outcome Related Fee Structures for Arbitration) Rules (Cap. 609D).

- Rule 3 of Arbitration (Outcome Related Fee Structures for Arbitration) Rules (Cap. 609D).

- Rule 5 of Arbitration (Outcome Related Fee Structures for Arbitration) Rules (Cap. 609D).

- Rule 6 of Arbitration (Outcome Related Fee Structures for Arbitration) Rules (Cap. 609D).

- Article 3(6) of Opinions on Further Regulating Lawyers’ Service Charges.

- Article 13 of Administrative Measures on Fees for Lawyer Services.

- Article 3(6) of Opinions on Further Regulating Lawyers’ Service Charges.

- Article 3 of Opinions on Further Regulating Lawyers’ Service Charges.

- Article 3(7) of Opinions on Further Regulating Lawyers’ Service Charges

- Section115(B)(1) of Legal Profession (Amendment) Act 2022.

- Section 115(B)(4) of Legal Profession (Amendment) Act 2022.

Reed Smith LLP is licensed to operate as a foreign law practice in Singapore under the name and style, Reed Smith Pte Ltd (hereafter collectively, "Reed Smith"). Where advice on Singapore law is required, we will refer the matter to and work with Reed Smith's Formal Law Alliance partner in Singapore, Resource Law LLC, where necessary.

Client Alert 2022-405